5 Ways that Business Travel is Shaping Bizav

The Global Business Travel Association (GBTA) has recently issued a report which suggests that global business travel spending will grow 7% in 2014, reaching a record $1.18 trillion by the end of the year. Here's how the global markets ranked in 2013:

When it comes to business versus leisure, the private jet market in Europe is highly seasonal, with a spike of summer leisure traffic during the months of June, July and August. But as we move back to business in September, a larger majority of private jet movements return to being for corporate usage.

Here are the Top 5 key trends that are shaping global business travel this year, and how this impacts the private jet market:

- China will overtake the USA

- Airfare and hotel costs will increase

- Crimean Crisis impact for Russia

- Japan jet market waiting to take off

- Technology is driving growth

1. CHINA WILL OVERTAKE USA AS BUSINESS TRAVEL LEADER

Business travel spend in China grew to $225 billion in 2013 (from just $32 billion in 2000), and the GBTA have forecast that China will be the lead market, overtaking the USA by 2016.

China’s private jet market is also showing a rapid rise. The geography of China is a perfect landscape for private jets – a vast landmass, located far from its key trading partners.

However there are still limited aircraft available (around 400 are based there). China also has air-space restrictions and far fewer airports (less than 400, compared to 18,000 in the USA).

But this is set to change, with military airports opening up for civil use and many more jets set to be delivered into the market in the next few years.

The private jet charter segment is also showing strong growth in China. PrivateFly regularly arranges private jet charters across the Asia Pacific region, accessing a network of both domestic and international aircraft.

2. Airfares and hotel rates are set to increase

The knock-on effect of business travel spend and confidence rising means that the travel industry will look to increase their prices.

However, with oil prices remaining stable (despite geopolitical impacts from Middle East and Ukraine), fare increases will be mild.

Private jet pricing is not likely to see any significant increase in the near future.

The market is still seeking a return to growth, and price sensitivity is a key factor in encouraging businesses back to using private jets again. Private jet charter pricing is highly competitive, and will remain so as we see returning confidence to the industry.

3. CRIMEAN CRISIS IMPEDES RUSSIAN MARKET GROWTH

Russia, a market that has seen big rises in business travel spending, is now under threat of plummeting due to the Ukrainian crisis.

Sanctions in place mean that GBTA have forecast more than 5% drop in business travel for Russia in 2014 (although it remains in the top 15 global markets at #11.)

Russian wealth has accounted for a key portion of the private jet market in the last 5 years, propping up the market from more significant recession impact.

The Russian market continues to be a strong contributor to the private jet market, but more so for those based outside of the country.

In July 2014, business aviation movements in Russia and Ukraine fell 12% and 49% respectively year on year.

4. JAPAN IN TOP 3 BUT PRIVATE JETS WAITING TO TAKE-OFF

In the top 3 global markets for business travel spend is Japan, behind China and the USA.

Although the forecast is projected to be lower this year, it's still big business with $61 million spend projected to the end of 2014.

By contrast Japan’s business aviation remains an immature market, with just 4 FBOs in the country and less than 90 aircraft.

Compared to its regional partner China, cultural attitudes to private jet travel are more hesitant and economic growth is lower.

There is also travel competition from its high-speed trains.

Bureaucracy in Japan is also such that business aviation is not a priority and there are limited slots.

But this could be set to change: Tokyo’s first dedicated business jet terminal opened earlier in 2014, and there has also been a relaxation on overseas aircraft movements and permits.

Japan is also featuring on the global private jet stage with the impending launch of HondaJet.

The small jet is set for certification and market entry in 2015.

5. TECHNOLOGY IS DRIVING BUSINESS TRAVEL GROWTH

The continued growth of the Business travel industry globally is being enabled through technology solutions.

At the recent GBTA Convention, Google’s Director of Travel partnerships, David Pavelko shared his vision of the future of travel, showcasing IPITA (Integrated Proactive Intermodal Travel Assistant).

This virtual travel assistant optimises travel planning, booking and navigation and will be realistic within the next 10 years.

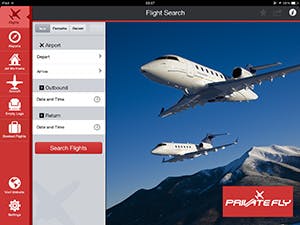

The private jet industry is also seeing rapid change through technology, and booking a bespoke product like a private jet charter flight is now possible (and easier) online – with dramatic enhancements in booking leadtimes and price transparency.

For further information on business travel flights contact us online or call {{telephone}}